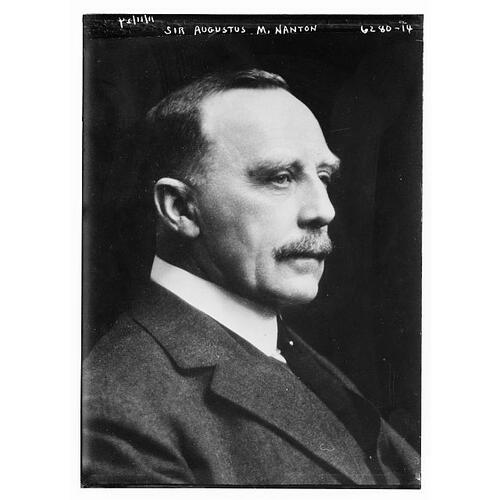

![Description English: Sir Augustus Meredith Nanton (1860-1925) Date 20 April 2012 Source Library of Congress Author Creator(s): Bain News Service, publisher Date Created/Published: [no date recorded on caption card] Medium: 1 negative : glass ; 5 x 7 in. or smaller. Reproduction Number: LC-DIG-ggbain-37681 (digital file from original negative) Rights Advisory: No known restrictions on publication. Call Number: LC-B2- 6280-14 [P&P] Repository: Library of Congress Prints and Photographs Division Washington, D.C. 20540 USA http://hdl.loc.gov/loc.pnp/pp.print

Original title: Description English: Sir Augustus Meredith Nanton (1860-1925) Date 20 April 2012 Source Library of Congress Author Creator(s): Bain News Service, publisher Date Created/Published: [no date recorded on caption card] Medium: 1 negative : glass ; 5 x 7 in. or smaller. Reproduction Number: LC-DIG-ggbain-37681 (digital file from original negative) Rights Advisory: No known restrictions on publication. Call Number: LC-B2- 6280-14 [P&P] Repository: Library of Congress Prints and Photographs Division Washington, D.C. 20540 USA http://hdl.loc.gov/loc.pnp/pp.print](/bioimages/w600.1991.jpg)

Source: Courtesy of Wikimedia Commons

NANTON, Sir AUGUSTUS MEREDITH, broker, financier, capitalist, and philanthropist; b. 7 May 1860 in Toronto, son of Daniel Augustus Nanton, a barrister, and Mary Louisa Jarvis, daughter of William Botsford Jarvis*; m. first 7 Dec. 1886 Georgina Hope Hespeler (d. 1887), daughter of William Hespeler, in Galt, Ont., and they had one daughter; m. secondly 17 Nov. 1894 Ethel Constance Clark in Winnipeg, and they had two sons and two daughters who survived infancy; d. 24 April 1925 in Toronto and was buried in Winnipeg.

The death of his alcoholic father forced 13-year-old Augustus Nanton to leave the Toronto Model School to help support his mother and younger brother and sisters. His first position was as an office boy in a real estate firm. Two years later, in 1875, through the influence of an uncle, he obtained a junior clerical position at $300 a year in Edmund Boyd Osler’s brokerage firm, Pellatt and Osler. Around 1881 Osler appointed him to look after the accounts of the Aberdeen-based North of Scotland Canadian Mortgage Company Limited, which the firm represented.

In 1882 Osler broke with his partner, Henry Pellatt, and founded, with Herbert Carlyle Hammond, secretary of the Bank of Hamilton, the firm Osler and Hammond. Osler retained the agency of the North of Scotland and kept Nanton with him as its secretary. The following year the partners sent Nanton to Winnipeg on behalf of the Aberdeen company to report on investment opportunities in farm mortgages in the northwest. Nanton’s shrewd mind intuitively grasped the opportunities offered by the region to create untold wealth and to further his own ambitions. In 1884 he returned to open a Winnipeg office as a junior partner in the Toronto firm’s western branch. Through the agency of Osler, Hammond, and Nanton, the North of Scotland was one of the first companies in the northwest to finance first mortgages, or purchase municipal and school debentures, to any significant extent. Nanton tirelessly promoted the Scottish business and by the end of the first year made £28,629 worth of loans; ten years later capital investment had risen to £315,664 under his management.

Nanton’s business in mortgages and debentures was closely bound up with the sale of farm lands and town lots and the encouragement of immigration. From the start Osler, Hammond, and Nanton was the selling agent for the Ontario and Qu’Appelle Land Company Limited and the Canadian Pacific Railway’s land-grant bonds. In 1885 the firm undertook the purchase and sale of land scrip but Nanton refused to deal with speculators, saying, “I do not want to buy scrip from dealers and scalpers who rob the half-breeds, but I will buy direct from the Owners at a good price.” The firm eventually accumulated the largest scrip account in government records. In the 1880s as well Nanton became involved in the Manitoba Cartage and Warehousing Company, one of the early important businesses in Winnipeg and western Canada. Elected a director within a few years of his arrival there, he became president in June 1891.

About 1890, through Osler’s involvement in the financial organization of the Qu’Appelle, Long Lake and Saskatchewan Railroad and Steamboat Company and the Calgary and Edmonton Railway [see James Ross*], Nanton had undertaken responsibility for the promotion and coordination of immigration to and settlement of the lands of these important colonization railways. That same year he became general agent for Elliott Torrance Galt’s Alberta Railway and Coal Company of Lethbridge. The following year he established a coal department to wholesale Galt’s bituminous coal. Later he introduced different varieties of American and Canadian coal. When Galt amalgamated the AR&CC with his other companies under one roof in 1904 as the Alberta Railway and Irrigation Company, Osler, Hammond, and Nanton proceeded to purchase all the available shares; in June of the following year Nanton became the ARIC’s managing director. His growing prominence in a variety of business activities had been recognized in 1898 when he was elected president of the Winnipeg Board of Trade. That same year he became a director of the Great-West Life Assurance Company [see Jeffry Hall Brock*]. The following January he was made a director of the Winnipeg Electric Street Railway Company (later known as the Winnipeg Electric Railway Company) and appointed to its three-man executive committee.

In 1900 Nanton and several other businessmen, including William Hendrie*, incorporated the Winnipeg Western Land Corporation Limited, which owned land along the line of the Manitoba and North-Western Railway near the Yorkton and Beaver Hills districts (Sask.). The firm also owned considerable acreage in Manitoba’s fertile parklands and for many years Nanton was the company’s land commissioner in the province. In 1908 he became president of the Canada Saskatchewan Land Company, which had 400,000 acres for sale in Saskatchewan.

To protect Osler, Hammond, and Nanton’s considerable investment in mortgages, Nanton had entered the field of fire insurance in 1899. This new departure provided the basis for later expansion into all classes of insurance, excepting life. Next he established a stocks department and a bonds department. In 1903 he became one of the founders of the Winnipeg Stock Exchange, of which he was the first president. It was not until February 1909, however, that formal trading commenced. Since the demand for first mortgages eventually exceeded the North of Scotland’s financial resources, Osler, Hammond, and Nanton expanded its agency to include several other loan companies. With increasing amounts of private investment capital coming into the firm from clients in Great Britain and central Canada, Osler and Nanton (Hammond had died in 1909), along with the firm’s barrister and two junior Winnipeg partners who had joined the firm in 1908, incorporated the Osler and Nanton Trust Company in 1911.

Through his intimate business association with Osler, who in 1901 had become president of the Dominion Bank, Nanton had been appointed one of the bank’s directors in 1907. He became a vice-president in 1919 and on Osler’s death in August 1924 he succeeded to the presidency. In 1910 Nanton had been appointed vice-president of the Great-West Life Assurance Company. It was his appointment in 1912 as secretary to the Canadian advisory committee of the Hudson’s Bay Company, however, that clinched his reputation as a dominant figure on the national financial stage. The services of this local committee, composed of a small but select group of mainly western businessman, were initially of a limited scope. Later the London committee of the HBC granted the committee extended authority as its Canadian representative and renamed it simply the Canadian committee to reflect its newly acquired powers. In 1914 Nanton was elected to fill the vacancy on the London committee of the HBC left by the death of Lord Strathcona [Smith*]. With the death in that same year of Sir William Whyte*, a former vice-president of the CPR, whom he had long advised, Nanton assumed Whyte’s vacant chairmanship of the HBC’s Canadian committee, as well as his place on the CPR’s board of directors. Four years later he was appointed to the executive of the CPR’s board.

The vigour and intelligence that Nanton exhibited in his business pursuits carried over into his enthusiastic support for the Canadian war effort in defence of the empire and British tradition. With the outbreak of World War I, he joined the national executive of the Canadian Patriotic Fund at the invitation of the governor general, the Duke of Connaught [Arthur*]. The organization raised and administered funds for the support of needy dependants of servicemen. He was also president of the Manitoba Patriotic Fund, the only provincial organization to remain independent of the national body. His leadership was a key factor in its success. The money collected and distributed by the Manitoba organization was the largest per capita in the country. Nanton himself generously contributed $1,000 a month. He derived his deepest satisfaction, however, as chairman of the provincial approval committee whose primary purpose was to encourage young men to enlist through assurances that their dependants would be provided for during their absence. The committee did “more towards recruiting . . . than anything else,” said Nanton with the profound conviction of one who felt that he was directly participating in the management of what he described as “this most righteous war.” For his remarkable contribution he was made a knight bachelor on 13 June 1917. The same skilful management he had shown in this organization led to his appointment as a member of the first board of governors of the University of Manitoba when that body was created the preceding month.

During the Victory Loan campaigns of 1917, 1918, and 1919, Nanton figured prominently in the mobilization of the country’s financial resources. He served on the executive of the Victory Loan Committee of Canada and was chairman of the Manitoba general committee. As the only westerner on the national executive, he helped to organize bond-selling committees in Saskatchewan and Alberta based on the Manitoba organization. The appeal for funds imposed, in his view, an “imperative claim upon every patriotic citizen,” and anyone who did not subscribe “ceases to be a good citizen of the Empire.” Nanton himself purchased $250,000 worth of bonds in each of the first two campaigns. Systematic canvassing in the prairie provinces raised the astonishing sum of over $246,000,000 in the three campaigns, while Manitoba alone subscribed to $118,000,000. Nanton’s biographer, Roderick George MacBeth*, observes that thanks to Nanton’s stewardship, westerners “became lenders for the first time in their history.”

After the signing of the armistice in November 1918, the threat of a general strike which had been brandished in the summer of 1917 became a reality the following spring. Nanton viewed the Winnipeg General Strike [see Mike Sokolowiski*] as an act of treason and became an influential member of the Citizens’ Committee of One Thousand, composed of businessmen who opposed the strike and sought to maintain essential services. His antagonism towards collective bargaining and industrial unionism, fuelled by a vigorous nativist sentiment, went back to 1906 and the violent strike by the workers at the Winnipeg Electric Railway Company and the particularly long and bitter miners’ strike at the Galt collieries in Lethbridge [see Frank Henry Sherman*], in which Nanton, as managing director of the ARIC, had been closely involved.

Elected president of the Winnipeg Electric Railway Company in 1919, Nanton anxiously sought to get on with the industrial development of Winnipeg. The company’s power project at Great Falls had been suspended in 1916 because of the war. Work resumed in May 1919, but was soon halted because of a shortage of materials and tight money. Construction started again in 1920, when the Manitoba Power Company, organized as a subsidiary of the Winnipeg Electric Railway Company with Nanton as president, took over completion of the generating station. Nationally, Nanton focused his patriotic zeal on the promotion of Canada’s industrial and agricultural interests as a member of the executive of the Canadian Reconstruction Association founded in 1918 [see Sir John Stephen Willison].

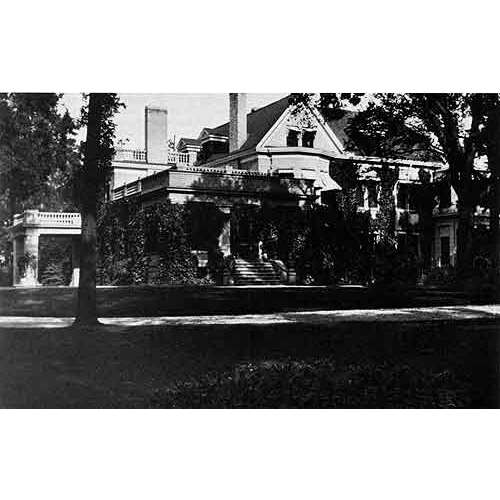

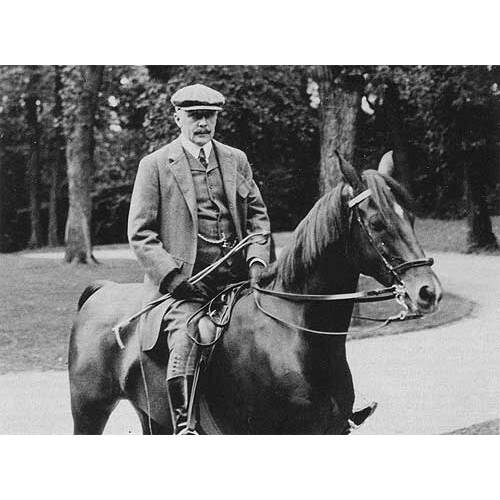

Austere and patrician in manner, Nanton was a natural aristocrat who, even before the turn of the century, had accumulated considerable wealth. His sumptuous Winnipeg estate, Kilmorie, conspicuously expressed his commanding position in the community. From junior clerk, Nanton had proved his mettle in one undertaking after another. He eventually became associated with an impressive array of prosperous enterprises in an advisory or active capacity. On the death of Osler, the senior partner, in 1924 Nanton stepped into his shoes as executive head of the firm Osler, Hammond, and Nanton. He owed much to this trusted friend and counsellor, who had taken him under his wing and guided him like a father in the early stages of his career. Between Nanton and Osler there existed a close relationship born of deep respect and admiration that stood, “without a single misunderstanding or dispute,” for 40 years. Faced with an important decision, Nanton would always examine the matter from the deeply conservative instincts inherited from his mentor.

Nanton was, above all, a nation builder who aimed to develop the northwest from a region dependent upon central Canada and Great Britain for immigration and development capital to one capable of generating its own wealth. The wider aspirations of his expansionist vision embraced a stable and civilized life stretching across the prairies through the development of town-sites to serve as centres of rural economic life. Winnipeg would become a manufacturing and distribution centre, as well as an important source of capital within the expanding nation. Nanton’s sudden death eight months after he assumed the presidency of the Dominion Bank saw the passing of one who had helped lay the foundation of sound financial organization for the development of western Canada.

ACC, Diocese of Rupert’s Land Arch. (Winnipeg), DRL-84-111, RBMB; 112, RBMB; 129, RBMB. Man., Dept. of Consumer and Corporate Affairs, Corporations branch (Winnipeg), Partnership agreements, file no.580, 30 Sept. 1884; index no.83w, 25 June 1902. PAM, GR 1418, G-1-7-3, MH0035, book 1; MG 14, C85; P 483. Private arch., David Nanton (Vancouver), Paul Nanton, “Prairie explosion: setting the pace for Canada” (typescript, 1991). Trinity Anglican Church (Cambridge, Ont.), RBMB, 1874-88: f.204, no.81. Univ. of Aberdeen Library, Dept. of Special Coll. and Arch. (Aberdeen, Scot.), ms 3211/1-84 (North of Scotland Canadian Mortgage Company Limited), Ledgers, nos.2–3; Minutes. Manitoba Free Press, 1 May, 1 July 1884; 20 Feb. 1885; 2–3 Feb. 1909; 12 May 1914; 4 June, 8, 17, 26 Nov. 1917; 8, 14 Nov. 1918; 28 Oct. 1919; 13 Aug. 1924. Monetary Times (Toronto), 25 July 1919. Winnipeg Telegram, 29 Jan. 1910, 13 Feb. 1919. Winnipeg Tribune, 26 Feb. 1930. Canadian annual rev. (Hopkins), 1919. The Canadian Patriotic Fund: a record of its activities from 1914 to 1919, comp. and ed. P. H. Morris ([Ottawa, 1920?]). London Gazette, 8 Aug. 1917. R. G. Macbeth, Sir Augustus Meredith Nanton: a biography (Toronto, 1931). Newspaper reference book. E. B. Osler, Osler, Hammond & Nanton Limited: commemorating 65 years of business development in a growing nation (Winnipeg, [1948]). A. A. den Otter, Civilizing the west: the Galts and the development of western Canada (Edmonton, 1982). Osler, Hammond & Nanton, New homes, free farms in Alberta and Saskatchewan, western Canada ([Winnipeg, 189?]); The Qu’Appelle, Long Lake and Saskatchewan Railroad and Steamboat Co. has 1,000,000 acres of odd numbered sections . . . (Winnipeg, [1891?]).

Cite This Article

Peter Hanlon, “NANTON, Sir AUGUSTUS MEREDITH,” in Dictionary of Canadian Biography, vol. 15, University of Toronto/Université Laval, 2003–, accessed December 23, 2025, https://www.biographi.ca/en/bio/nanton_augustus_meredith_15E.html.

The citation above shows the format for footnotes and endnotes according to the Chicago manual of style (16th edition). Information to be used in other citation formats:

| Permalink: | https://www.biographi.ca/en/bio/nanton_augustus_meredith_15E.html |

| Author of Article: | Peter Hanlon |

| Title of Article: | NANTON, Sir AUGUSTUS MEREDITH |

| Publication Name: | Dictionary of Canadian Biography, vol. 15 |

| Publisher: | University of Toronto/Université Laval |

| Year of publication: | 2005 |

| Year of revision: | 2005 |

| Access Date: | December 23, 2025 |