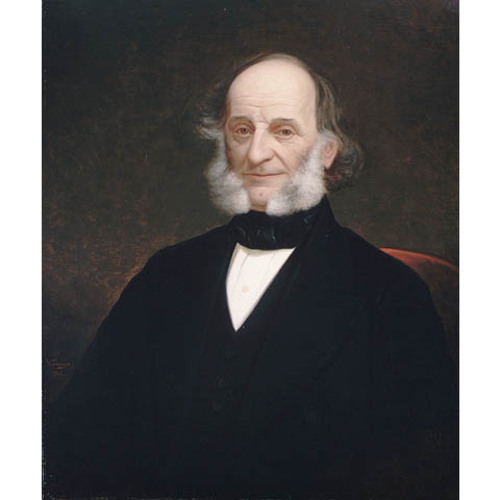

MOLSON, WILLIAM, brewer and distiller, merchant, and banker; b. 5 Nov. 1793 at Montreal, L.C., third and last son of John Molson* Sr and Sarah Insley Vaughan; d. 18 Feb. 1875 at Montreal.

Little is known about William Molson’s childhood, except that it was spent amid the influence of a family of entrepreneurs. His father, who had arrived at Montreal in 1782, an orphan of 18 years of age, had immediately ventured with his friend James Pell into the lucrative trade in foodstuffs, especially meat, that was a feature of the years of high inflation caused by the American Revolution. He had also gone into the production of beer with his friend Thomas Loid. In 1785 he became sole owner of the brewery. John Molson Sr refused, however, to take part in the active fur trade on which, during these years when the North West Company was being formed and the Beaver Club instituted, Montreal’s commercial activity was based. All his life he opposed by his activities this structure of a staple economy. He was above all an industrial entrepreneur, if we can agree not to consider this term an anachronism given the slow progress of manufacturing at that period. His three sons were to be profoundly marked by this pattern, William like the others, but in his own way.

William was only 16 when his father, having bought the shares of his two partners John Bruce and John Jackson, to whom he had given financial assistance for the building of a steamboat, launched the Accommodation on 19 Aug. 1809, the first steam vessel to ply the St Lawrence between Montreal and Quebec. William went to school at that time, but his interest and activity were already centred on the family enterprises. On 19 Oct. 1810, on the eve of a departure for England, John Molson prepared a will before a notary, in which lie mentioned the activity of his two youngest sons, Thomas*. and William, as brewers, and committed them to the care of John*, his eldest son. The latter, in a letter to his father on 6 Jan. 1811, wrote: “William is still at school and I believe he can go the whole season as we will endeavour to do without him. He is growing fast and is nearly as tall as I am.”

When war broke out between England and the United States in 1812, young William, aged 19, entered the militia as a volunteer. By October 1812 he had obtained an ensigncy. The Molsons’ shipping company profited considerably from this war, taking soldiers who had arrived at Quebec to the Upper St Lawrence with their arms and baggage. The writer Bernard Keble Sandwell* states that William, despite his youth, commanded the Swiftsure during the war. At the end of the war, during at least two shipping seasons, John Sr and Jr corresponded, each from the ship he commanded, and their letters show that both were engaged in transactions involving bills of exchange from Montreal to Quebec and London, a prelude to their future activity as bankers. The youngest son also profited from these transactions. In a letter of 24 June 1815 to his father, John Jr wrote: “I have also purchased a bill for William of 110 Pounds.” At this period the eldest son was established at Quebec to direct the wharf and warehousing operations, with the double responsibility of handling general merchandise for the shipping business and of taking delivery of and selling beer in the Quebec area for the Montreal brewery.

The first contract of partnership between the father and his three sons, under the name of John Molson and Sons, was signed before a notary on 1 Dec. 1816. Each remained the owner of the assets that he contributed to the company, and received on their value an annual interest of 6 per cent. The capital of the company came from John Sr, except for the ship Swiftsure, which he had given to the eldest brother. The latter was responsible for all the business at Quebec, where; he resided; Thomas and William would live at Montreal, where they would work under their father’s direction. It was mentioned that Thomas would be in charge of the brewery. The company’s profits would be divided equally between the four partners. The uncollected profits, which were left in the enterprise, were capitalized. A reckoning of capital, dated 1 April 1819, shows that William had already accumulated £7,165 12s. 8d.

We do not know when William moved to Quebec to replace his elder brother and assume responsibility for the business in that town, but in 1819, at the time of his marriage, he moved to a house at 16 Rue Saint-Pierre and was to remain there until 1823. On 7 Sept. 1819, in the Anglican Christ Church, Montreal, William married Elizabeth Badgley (1799–1887), daughter of Francis Badgley* and sister of John Thompson Badgley (of whom William became a partner in 1830) and Judge William Badgley*. Their first two children were born at Quebec.

William probably developed his liking for politics at this period. In fact it is more than likely, that his father entrusted him with the task of carrying on certain lobbying activities that were: concomitant, on the one hand with John Sr’s shipping business, and on the other with his status as member of the assembly since his election in the county of Montreal East on 25 April 1815. In the eyes of the entrepreneurs it was urgent that authorization be granted to build a wharf on the beach at Montreal, near the new market, an authorization which up to then the colonial authorities had persistently refused, out of respect for the crown monopoly on beach right of way. John Molson Sr remained a member for Montreal East until he lost his seat in the election of 1827, a few months after he had been made president of the Bank of Montreal.

When Thomas, in the spring of 1822, after his first experiments with making whisky, decided to try to sell it in England, he sought help from his brother William at Quebec with the necessary customs formalities. Meanwhile, William continued to capitalize part of the income paid by John Molson and Sons to the four partners; a reckoning dated 9 Feb. 1822 indicates that William’s share amounted to £10,813 8d.

In the same year an important event, with repercussions on the assets of the family firm, took place in the shipping company. In April 1822 the Molsons succeeded in obtaining control of the shipping undertakings that since 1815 had been competing with them on the St Lawrence. Thus, in addition to the ships they already owned were added the Car of Commerce, property of a group of men that included Horatio Gates* and Jabez Dean De Witt; Thomas Torrance’s and David Munn’s Caledonia; the Telegraph from Montreal; the Québec, owned by a group that included Noah Freer; and a few other ships.

The competition had entailed overcapitalization and a considerable wastage of resources. With the arrival of a period of stagnation and of serious and numerous economic crises, consolidation became essential. In April 1822 the St Lawrence Steamboat Company was formed; it brought together the vast majority of the steam navigation interests on the St Lawrence. The company was made up of 44 shares of £1,000 each, the four Molsons holding collectively 26 and individually 6 1/2 each. Furthermore, the firm of John Molson and Sons was appointed to manage the company. This new responsibility resulted in the separation of the shipping enterprise from the activities of the Molson family. In book-keeping terms, it implied the withdrawal of the most important components (ships, wharves, and warehouses) of the assets of the family enterprise.

According to certain documents, John Jr seems to have returned to Quebec, and worked there in 1822 together with William, while Thomas stayed at Montreal, in sole charge of the brewery for several months. Thomas did not have a marriage contract, and the difficulties this entailed in a country whose law was that of France’s ancien régime, persuaded him to leave Montreal in 1824 for Kingston, Upper Canada, where he became a brewer and distiller. In fact, for an entrepreneur joint estate was unthinkable. When it came time to negotiate a new partnership, with the expiry after seven years of the 1816 contract, John Jr maintained that he could leave Quebec for Montreal and take the direction of the brewery from Thomas. The father intervened, however, and insisted that William should leave Quebec, move to Montreal near him, and take charge of the brewery. “John fansied he could manage the Brewhouse himself,” John Molson Sr wrote to Thomas on 4 January. “I told him not, have had William near a fortnight.”

The new contract was signed at the beginning of 1824 but applied retroactively to 1 Dec. 1823, the date on which the previous firm’s accounts were closed. The partners were John Molson Sr, John Jr, and William. The assets consisted of the property of John Sr: the brewery and hostelry establishments at Montreal and the businesses at Quebec. The firm had the same name as the previous one: John Molson and Sons. It was also in 1824 that William’s third and last child, Anne*, was born.

In 1828 the Molsons decided that the companies in which they participated should be diversified according to the nature of their undertakings. Thus the firm of John Molson and Sons became exclusively responsible for steam navigation, as an agent of the St Lawrence Steamboat Company. Around 1830 the firm took over control of the Ottawa Steamboat Company, which held the monopoly for steam navigation on the Ottawa River. In 1834, with the opening of the Rideau Canal, this company became the Ottawa and Rideau Forwarding Company and was to dominate steam navigation from Montreal to Kingston.

The other undertakings of the family were from 1828 managed by a new company, founded that year, that of John and William Molson, which brought together the father and his two sons, John and William. For reasons which remain obscure, John Jr withdrew from this company in April 1829, and thus brought about its dissolution. But a new company, John and William Molson, was immediately formed on 30 June 1829, bringing together this time the father and William, his youngest son.

During the next five years William was in sole charge of the brewery. In addition, he undertook the management and administration of St Mary’s Foundry, a small metallurgical enterprise, probably originally called the Bennett and Henderson Foundry. As well as selling implements for the building of the Rideau Canal, William closely followed the foundry’s work in 1831 on the Royal William, the first ship entirely powered by steam to cross the Atlantic.

At this period William launched out into commerce. From 1 May 1830 to 14 Feb. 1834 he worked in partnership with his brother-in-law, John Thompson Badgley, to set up, with the help of funds advanced by his father, a business for the importing and retail sale of all kinds of goods from England. They operated under the name of Molson and Badgley. According to newspaper advertisements of the time, it appears that William was competing with John Jr, who on 1 May 1829, with George and George Crew Davies, had established the firm of Molson, Davies and Company, in exactly the same business.

However, it does not seem that the competition between the two brothers had any deep significance. Thus, when the Champlain and St Lawrence Railroad Company was founded in 1831, both brothers sat on the board of directors, together with Peter McGill* and Jason C. Pierce; John Jr was president. This company built the first Canadian railway, the one that in 1836 linked Laprairie-de-la-Madeleine on the St Lawrence with Saint-Jean on the Richelieu, a distance of 20 miles.

Both William’s activities as an industrialist and his wealth continued to expand. The will that he prepared on 3 Aug. 1832 before the notary Henry Griffin permits us to evaluate the approximate extent of his fortune. He left an annuity of £400 to his wife which, at the then usual rate of interest of 6 per cent, represents a principal of nearly £7,000, and £6,000 to each of his two daughters. The will also directed that his sons (he had only one) be residuary legatees.

In contrast to his son’s expanding activities, those of the father continued to decline. However, the latter became more active in political and social life. He was appointed a legislative councillor in 1832, and was a member of the Constitutional Committee of Montreal (in 1835, the Constitutional Association of Montreal), a political movement formed to defend the interests of the English-speaking bourgeoisie of Montreal against the activities, which it considered menacing, of the Patriotes. William played an important role within this organization. A letter he wrote to his father on 16 Nov. 1834 gives evidence about the unrest which was already prevalent in Montreal in 1834. “The election in the western ward [Louis-Joseph Papineau was a candidate] still remains unsettled, but am sorry to say that every night there are disturbanses in the streets, people beaten, and glass or windows of houses broken.” In 1835 he was named commissioner to hear minor cases (litigation involving amounts of less than £6 5s.).

In 1833, William Molson, then in the full vigour of manhood, had begun a new operation destined to become much more lucrative than brewing: distilling. He obtained the necessary equipment in the spring and began to purchase raw materials after the autumn harvests. In December 1833 or January 1834 distillation actually began. In January 1834 William asked Robert Shaw of Quebec to be his agent in that town for his product. His partnership with his brother-in-law, John Thompson Badgley, came to an end in this period. On 14 Feb. 1834 an act by the notary Henry Griffin dissolved the firm of Molson and Badgley.

The same year Thomas Molson decided to leave Kingston and return to Montreal to go into partnership with his father and his brother William. A new company was then formed bringing together the father, William, and Thomas. The contract was signed on 21 Feb. 1835, and was retroactive to 30 June 1834. The share capital of the firm of John Molson and Company was divided into eight portions: two for John Sr, three for Thomas, and three for William. The father contributed the physical capital, namely all his establishments, for which he drew an annual rent of £1,100, representing a rate of 6 per cent of their value. Profits and losses were to be distributed in proportion to the number of shares held by each partner.

This partnership began a close collaboration, which was to last nearly 20 years, between the two brothers. In a commercial economy, at grips with the considerable difficulties that inevitably accompanied frequent and also profound crises, William and Thomas Molson, with surprising persistence, identified themselves as industrialists. True, the products of their establishments met demands that economists call inelastic, that is to say a rise in prices or a fall in income did not lead to a diminution in production. Perhaps even the demand for spirits was at that period “countercyclical,” in the sense that an economic crisis might make it go up. And a fall in the price of the raw materials might well have been more important than a fall in the price of the finished product, since it would enable the entrepreneurs, when the demand varied little, to increase their profits at the height of an economic crisis.

But the Molson brothers were in opposition to their society, both from the economic and from the social and cultural point of view. In a mercantile economy, the whole structure is centred on export and import trade. The principal source of public revenue is customs, customs duties on exports and on imports. A tacit agreement is established between the state and the large merchants, encouraging foreign trade and discouraging national production. Such is the “staple trap,” as critics of this famous theory of economic development have called it.

Customs duties on the importation of spirits were an important source of fiscal receipts, the more because this revenue fluctuated little throughout the trade cycle and did not fall in a time of crisis, when other sources of income run dry. With the increase in the production of spirits, in the early 1830s began “the battle of whisky against rum,” which brought into conflict industrialists who produced spirits and a coalition of large merchants and the state. The Montreal Board of Trade made itself the eloquent spokesman of the large merchants when the governor of the colony consulted it in order to ascertain the cause of a fall in treasury receipts. But it was also the whole puritanical society of the time that the producers of spirits were up against, because to their activity was imputed responsibility for popular behaviour. Consequently, in a period of flourishing evangelical revival, they were the prey of preachers of all sects. The decision of William and Thomas during the 1840s to build the church of St Thomas’ in the district where their factories stood, did not, apparently, allay this animosity.

The partnership of William and Thomas was furthermore directed against their eldest brother. John Molson Sr died on 11 Jan. 1836. William exclusively received all the properties situated at Près-de-Ville (Quebec): wharf, warehouses, houses, other buildings, and all the land. St Mary’s Foundry reverted to John Jr. The brewery, whose buildings also housed the distilling equipment, became the property of John Henry Robinson Molson, Thomas’s eldest son. This clause thus enabled John Henry Robinson to avoid the risks involved in the system of joint estate that governed the marriage of Thomas and Martha Molson. But the boy was only nine. The will stipulated that until he reached his majority the brewery should be directed by Thomas and William, according to the terms of the company established in 1835. The three sons were in addition named residuary legatees. John claimed that as residuary legatee he had the right to share in the profits of John Molson and Company, and that the credits remaining, in the form of invested income, on properties sold at Quebec before their father’s death, did not form part of William’s personal endowment, but of the residuary legacy. The Honourable Peter McGill and George Moffatt*, who had been nominated by John Sr to act, with his three sons, as executors, withdrew when they saw dissensions arise, but in 1842 they agreed to act as arbitrators. They declared John to be right in the matter of sharing in the profits of the company, and William to be right in respect of the Quebec credits. In addition to the shares he already owned and those he received as residuary legatee, William may have had a third of the controlling shares held by the Molsons in the St Lawrence Steamboat Company.

The firm of John Molson and Company came to its scheduled end on 30 June 1837. A new company was formed under the name of Thomas and William Molson. On 5 Jan. 1838 fire destroyed a large part of the Montreal factories, and the Molson brothers obtained a sum of money as compensation from their insurance company. The arbitration board of 1842 decided that this sum was to be used to restore the buildings. Meanwhile the two partners had agreed to form a second company, unrestricted by the difficulties involved in carrying out their father’s will. On 25 April 1838 they founded the firm of Thomas and William Molson and Company. It is clear, from the various account books, that the sole object of the partnership of 1837 was to administer the brewery on behalf of young John Henry Robinson, whereas that of 1838 managed the distillery and brewery establishments, built after the fire, for the exclusive advantage of William and Thomas.

The combativeness of the two brothers in partnership did not stop there. Indeed, they ventured to attack the Bank of Montreal, the most powerful banking institution in the colony, by taking advantage of special circumstances to issue currency. Following their father’s death, John had been appointed to the board of directors of this bank to replace him. During the economic crisis of 1837 and the rebellions of 1837 and 1838, the government decided to suspend specie payments, from 16 May 1837 to 23 May 1838 and from 5 Nov. 1838 to 1 June 1839. In times of suspension several business houses took advantage of the situation to issue their own paper-money, which was convertible, not into coin, but into notes of the best known banks. Some did so in good faith, but others acted in a completely fraudulent manner; yet the practice was tolerated, for it was a way of avoiding the difficulties created by the scarcity of specie. The Thomas and William Molson Company, like many others, issued in 1837 notes bearing in this case the words “Molsons Bank.” Once specie payments had resumed, these “bills on sufferance” were supposed to be bought back by those who had issued them. William and Thomas abstained from withdrawing their notes from circulation and continued to issue new ones.

At the beginning of 1839, the Bank of Montreal and the Board of Trade prepared for the Special Council (of which John Molson had been a member since 1837) the text of a decree forbidding the circulation of private currency. On 1 March, the Molsons protested against the draft decree to the governor, Sir John Colborne*, and on 10 March they forwarded proposed amendments. The decree was none the less promulgated on 11 April 1839 and was to be in force by 1 June 1839, the date of the second return to specie payments. It provided in general terms that certain private banks could issue notes. On 18 May William and Thomas Molson asked that their enterprise be recognized as a private bank. The Special Council’s refusal was announced on 22 July. During all this time the two brothers continued to issue their private money illegally. On 8 November, the board of directors of the Bank of Montreal approved the managing director’s decision to refuse deposits made by the firm of Thomas and William Molson, and on 19 November instructed him to close the account of this firm by forwarding to it the £1,600 that remained in its balance. The Molson brothers’ situation was becoming precarious; for several months, no longer having any bankers, they had to do cash transactions with their suppliers and customers. In order not to lose credit with the public, they soon agreed to buy back the notes they had issued. After they had acquired a substantial block of shares in the Banque du Peuple, the latter agreed to receive them as customers. This institution was their banker from 1840 to 1844. When the new governor general, Lord Sydenham [Thomson* ], who was known for his plans for monetary and banking reform, arrived at the end of 1839, the two brothers again attempted to obtain a private bank licence. On 22 Dec. 1840 they presented their petition, which was refused in its turn on 31 December.

Such were the relatively troubled beginnings of this long association of William with his brother Thomas. The years of depression (1837–42), followed by a short expansion (1842–45) and the great commercial crisis of 1845–50, do not seem to have affected too grievously the common undertaking of the two brothers. On the contrary, they modernized their factories, and continued to add more important and more productive pieces of equipment. They got rid of some of their competitors by buying their businesses, such as the Handyside brothers’ in 1844, and John Michael Tobin’s small distillery on the Rivière Saint-Pierre in 1848.

The correspondence of the Molson enterprise shows that William, among other activities, had developed a certain specialization in relations with competitors and with the state. Thus it was he who negotiated cartel agreements with companies, and who saw that they were respected. No doubt because of his skill in this area, he was chosen by the brewing and distilling industry as a whole to defend their interests by lobbying parliament and certain ministries; it was indeed necessary to see that any increase of taxes on production and consumption was constantly discouraged, and that the laws restricting or forbidding the consumption of spirits were delayed and rendered less severe.

Was it to defend more effectively the collective interests of the brewers and distillers that William entered politics? When the municipal council for Montreal was re-established in 1840 (the city charter was not renewed in 1837) he accepted a nomination by the governor as councillor until 1 Dec. 1842. He was elected in December 1842 in Sainte-Marie ward and again in 1843. In April 1844, when the political “Metcalfe crisis” was at its height, William decided to stand for “the party of the governor,” Sir Charles Theophilus Metcalfe*, against the Irishman Lewis Thomas Drummond*, of the Reform party, in a by-election in the constituency of the town of Montreal. On 26 March, his friend John Young wrote to tell him that groups of Irish and French Canadian workers employed on the Lachine Canal were banding together to attack his supporters on election day. He urged William to ask for the protection of the police and the army. It was one of the most violent elections in Canadian history. It had been set for 11 April, but in view of the violence it was broken off and postponed until the 16th and 17th. On those days there were clashes, and soldiers intervened. But the returning officer, Alexandre-Maurice Delisle, declared that the electors had nevertheless had the opportunity to vote, and announced the election of Drummond. According to Jacques Monet, the powerful Temperance Society had displayed strong opposition to William Molson.

William’s solidarity with the Tory party explains why five years later he was closely involved in the annexationist movement, of which he was secretary, and why he signed the famous manifesto of 1849. Like all the signatories, William was the victim of repressive action by the colonial administration: he lost his rank, which he had obtained in 1847, as major in the 2nd Battalion of the Montreal militia, and it appears that he also lost his post as judge.

William’s wealth continued to increase. The will that he made on 24 April 1840 made his wife the beneficiary of an annuity of £500 – a principal of £8,000 when calculated at 6 per cent interest – and his daughters the beneficiaries, in equal parts, of the interest on a capital sum of $10,000 which would itself be given over to them on their coming; of age; his son was made residuary legatee.

At this period William’s career as an entrepreneur underwent a profound change. Perhaps his activity as a banker at the end of the 1830s had. produced a vocation that would now find expression: that of banker and financier. In 1843 he joined his eldest brother on the board of directors of the Bank of Montreal, on which the latter had sat continuously since their father’s death in 1836. It was also at the beginning of the 1840s that he was elected to the board of directors of the Mutual Insurance Company of Montreal.

The family also underwent profound changes in this period. His only son, William, died on 22 Jan. 1843 from smallpox. The funeral took place at the Episcopalian St Thomas’ Church, which William and his brother Thomas had just constructed. The marriage of his eldest daughter, Elizabeth Sarah Badgley, to David Lewis Macpherson* was celebrated at the same church on 18 June 1844. In 1845 it was the turn of his daughter Anne to leave the family circle and she married John Molson III, son of John Molson Jr. The rapprochement between the two brothers thus took on a new, deeper significance.

Around 1845 vast plans for railroad construction, which had been retarded by the economic crisis, began to be brought into effect in Canada, although it was not until 1850 that the building of the Grand Trunk was undertaken. But before 1850, some small railroads were built, radiating from Montreal in several directions. William Molson appeared on the boards of directors of a large number of these small companies, sometimes even as president. With him on the boards were often the Honourable James Ferrier* or his son-in-law David Lewis Macpherson. William was a director of numerous companies between 1845 and 1850: the Champlain and St Lawrence Railroad Company, the Champlain and New York Railroad Company, the Montreal and New York Railroad Company, the Montreal and Champlain Railroad Company, the Lake St Louis and Province Line Railway Company, the St Lawrence and Ottawa Grand Junction Railroad Company, the St Lawrence and Atlantic Railroad Company, and the Grand Trunk Railway Company. This list clearly contains a certain amount of duplication and repetition. Indeed, the railroad companies changed their names when some of them grouped together, or when they obtained from the government a supplementary tract of land over which they could extend their lines. And there is no proof all these legal entities actually built railways.

The extent of the sums William invested in these undertakings is not known. The Molson Archives contain numerous statements for purchased shares, but it is impossible to ascertain whether they are a complete inventory of his operations. It is known that on 12 March 1855 the board of directors of the Bank of Montreal advanced £3,000 to the Champlain and New York Railroad Company and that William alone personally guaranteed repayment of £1,000; this guarantee, by its size, is indicative. The significant thing, however, is that he took a close interest in the new forms that industrial capitalism was taking as it developed in Canada. Technological progress, and the increasingly large place the capital factor was assuming in the production process, were bringing about important shifts in the role of the entrepreneur, and leading to the formation of a capital market in Canada. At the same time the financiers in the mother country, particularly those of Baring Brothers, were beginning to show an interest in financing private companies in the colonies that were investing in the economic infrastructure.

William Molson was willing to adjust himself to the new capitalist structures. In future, a leading entrepreneur would no longer be a technician, who personally owned the means of production and administered an undertaking. It would from then on be too vast for individual or family ownership. Its large number of employees, and the complexity of the problems involved in organizing the work of factory and office, would no longer permit an entrepreneur to see to all the details of its daily running. The law would then adapt itself to the new economic structures and the joint-stock, limited-liability company would appear. The new entrepreneur was therefore no longer the exclusive owner of the means of production. Thanks to the control that he could exercise over the other shareholders, he did not even need to own a majority of the shares. From then on the top-ranking entrepreneur would be above all a financier. William Molson, in the new directions he gave to his activities, recognized the developments the Canadian economy, even western capitalism, was undergoing.

In 1847 William’s name appears along with that of his brother Thomas among the first group of shareholders of the New City Gas Company. This company, formed to provide the city of Montreal with a proposal for gas street lights, was in competition with an existing company but would soon bring about its disappearance.

The new structures of Canadian capitalism, which had developed during the late 1840s with the railroads, were to grow more firm in the mining industry at the beginning of the 1850s. William Molson showed a great interest in this field also. In different capacities, he was a member of various companies, in particular the Montreal Mining Company, the Upper Canada Mining Company, the British North American Mining Company, and the Quebec and Lake Superior Mining Association. Here again it would be hard to specify to what extent all these mining companies were developed and the importance of William’s participation.

While William was thus asserting new characteristics of his personality as a financier-entrepreneur, he was also preparing to break the long, close association with his brother Thomas. On 30 June 1848 Thomas and William Molson and Company, formed in 1838, reached the end of its contract, and a new agreement had to be signed. This was done on 12 July before the notary Isaac Jones Gibb, and was retroactive to 1 July. A new partner joined the undertaking, John Henry Robinson Molson, Thomas’ eldest son, who had reached his majority the previous year; he brought to the common undertaking the brewery he now owned. Each partner, as in the previous companies, remained the owner of the physical capital that he brought in and for which he drew an annual rent. From the brewery the young partner would get £500, and from the distillery William and Thomas would get conjointly £1,800. The profits would be distributed in the ratio of 10/24 for each of the senior partners and 4/24 for the youngest.

On 5 June 1847 John Henry Robinson had become 21. Normally, on that day he should have received possession of the brewery inherited from his grandfather, and the sum of £3,872 2s. 6d. from the insurance company in compensation for the damage that the business had suffered in the 1838 fire. On that day also William and Thomas should have handed him his indentures and taken him in at least as a salaried employee, by virtue of the articles of apprenticeship concluded between the youth and his two employers on 15 Nov. 1844, but which were retroactive to 1 Nov. 1843. The latter waited a year before delivering him his indentures and giving him the sum of money and possession of the brewery. The young man received no compensation for the interest that had accumulated for ten years on the sum paid by the insurance company and for the remuneration that had not been paid since the end of his apprenticeship. These actions would influence John Henry Robinson’s behaviour towards his father and his uncle William.

According to the contract, the new company would come to an end in ten years. But special provision was made whereby William could withdraw from it after five (on condition that advance notice of one year was given to his co-partners) without detriment to the structure of the undertaking. No doubt the early foundation of Molsons Bank was anticipated, as well as the broad outlines of the bill the Legislative Assembly was to pass in 1850, which would authorize the formation of private banks but forbid a banker to engage in any other business than that of the bank.

And in fact, on 24 June 1852, William did give his brother Thomas advance notice in writing. During the months that followed, the two brothers attempted to reach an understanding as to the value of William’s equity, which Thomas wanted to purchase. The latter offered £7,000; William demanded £8,000, and even threatened to sell to a third party if he did not get his price. The final agreement came on 11 Dec. 1852, and the sale took place on 18 December: William sold his share in the distillery (£8,000), two pieces of land (£122), five lots and a house (£738 10s.); the sum was payable three years after the date of William’s withdrawal on 1 July 1853, with an annual interest of 6 per cent. Even if the negotiations had sometimes been difficult, one cannot accept the hypothesis, suggested by Merrill Denison, of a quarrel between the two brothers. On 7 Jan. 1853 Thomas decided to leave for England, and gave his brother a general power of attorney for the administration of all his affairs. A rupture between the two brothers would have: prevented such confidence.

In 1850, the Legislative Assembly had passed the bill authorizing private banks. On 1 Oct. 1853 William Molson went into partnership with his brother, John Molson, to set up the firm of Molsons and Company. The name of Molsons Bank was registered on 3 December. The correspondence of Thomas Molson’s enterprises shows that during its first two years the new bank encountered certain difficulties in issuing and circulating its notes. In this period, when notes were convertible, it was permissible for a bank to accumulate the notes of a rival bank for a certain time, and to demand suddenly from that bank the conversion of the accumulated notes into coin; as a considerable sum might be involved, the stability of the latter’s cash balance might thereby be endangered. The Bank of Montreal, despite the wishes for success addressed by the members of its board of directors to William and John Molson at the time of their resignation, exerted this pressure on Molsons Bank, sometimes in collusion with the Bank of Upper Canada in Toronto.

Difficulties of this kind perhaps underlay the decision of the Molson brothers to withdraw from the regime set up by the private banks’ act, and to ask that their bank be placed under the system of charter banks, in operation since 1817. On 19 May 1855 Molsons Bank was legally constituted. It was to be directed, not by a company of individuals, but by a joint-stock company or “corporation.” The persons who had submitted this request were John, Thomas, and William Molson, George and John Ogilvy Moffatt, Samuel Gerrard*, James Ferrier, William Dow*, and Johnson Thomson. The new charter bank began operations on 1 Oct. 1855. On 22 October, the shareholders named their first board of directors: John, Thomas, William, and John Henry Robinson Molson, and Ephrem Hudon. The next day, at the first meeting of the board, William was elected president and John Jr vice-president.

Thereafter, William Molson’s career was to be characterized by his new activity as banker. Until his death he was the president of the family bank. However he continued to interest himself in one way or another in the mining and railroad companies of which he was a director. In addition he continued to direct certain small undertakings such as the Otterdorf and Heilman’s Soap Factory at Place Papineau, in which, according to certain documents dated 1855, he had a substantial interest. He also had real estate investments in certain areas of Montreal, particularly in the Sainte-Marie district, where the brewery and distillery establishments were, and where he lived himself on Rue Sainte-Marie (now Rue Notre-Dame) until shortly before his death. The great fire of Montreal, on 9 July 1852, had affected this district seriously and had destroyed three of William’s houses, one in Rue Sainte-Marie, the two others at Place Papineau.

Apart from the appreciation in the value of the shares that he held in the bank, and of the dividends that he drew from them, William received each year the sum of $2,000, not as a contractual payment but as a bonus voted by the shareholders at their annual meeting in recognition of his work. A few months prior to his death, at the annual meeting of 12 Oct. 1874, he refused to accept the sum, stating that he had not been able to concern himself with bank business during the previous year.

During the late 1860s and early 1870s, Molsons Bank developed considerably, and extended its operations in Quebec and Ontario. In February 1875, however, at the time of William’s death, the Canadian economy was experiencing the effects of the great world crisis of 1873 and of the long depression that was to last until 1879. It is this that explains the financial disaster which befell one of William’s last undertakings: the production of iron by the treatment of the magnetic iron sands found at the mouth of the Rivière Moisie, in Baie des Sept-Îles on the north shore of the St Lawrence. In this venture William had been closely associated with his nephew William Markland, Thomas’s son. The two Molsons had controlled the Moisie Iron Works Company since 1867; their manager from 1867 to 1869 was Louis Labrèche-Viger. The bulk of the production was exported to the United States. The crisis of 1873 brought about a sudden drop in demand, and a change in the American government’s tariff policy and the tariff structure placed Moisie iron in such a heavily taxed category that its price in the United States became prohibitive, and the Molsons were never able to sell their iron there again. A few months after William’s death the enterprise had to close its doors and the company had to declare itself bankrupt.

During a great part of his life William showed much interest in McGill University and the Montreal General Hospital. As in every industrial and financial community, in a young country, certain large educational and health institutions derive financial resources and administrative competence from the generosity and initiative of entrepreneurs; one can go so far as to say that in defining an entrepreneur’s place in society one must include almost of necessity an active interest in such institutions. In 1856, when a fundraising campaign was started on behalf of McGill University, 50 donors paid £15,000, the three Molson brothers alone giving £5,000, the income from which was earmarked for the endowment of a chair of English language and literature. In 1861 William gave a sum large enough to cover the cost of constructing William Molson Hall, a wing added to the west end of the arts building. The obituary notices published in the Montreal newspapers stressed that he had made a gift of $5,000 to the Montreal General Hospital, and a few months before his death a further gift of $2,000 for the endowment of the convalescent home of the hospital. During much of his life he was a member of the boards of governors of these two large institutions. In 1868 he succeeded John Redpath* as president of the Montreal General Hospital. The Saturday Reader of 8 Sept. 1866 stressed that William Molson was one of those who promoted the founding of the Hospice de Montréal. In the same way he supported places of worship. In 1866 Mrs William Molson, at the cost of £2,000, had built the two stories of the tower and the spire of Trinity Church, at the northwest corner of Place Viger.

William Molson had prepared his last will on 18 May 1865. He completed it with two codicils, one dated 22 Nov. 1869 and the other 31 Jan. 1870. He left all his possessions to his wife, his two daughters, and his 12 grandchildren. It is interesting to note that by the codicil of 1870 he expressly named his successor to the presidency of Molsons Bank: his son-in-law John Molson III, the son of his brother, John Molson Jr.

William Molson died on 18 Feb. 1875 and was buried in Mount Royal cemetery where, after the death of John Jr in 1860, was erected a huge monument, topped by an obelisk. William’s death was announced in all the newspapers of the time and in resolutions adopted by the shareholders’ meetings and the boards of directors of the companies and institutions with which he had been the most closely connected. Each vied with the other in praising the dynamic nature of the entrepreneur and the humane qualities displayed throughout his life by the man William Molson.

Thanks to the perspective afforded by time, it is possible to look at William Molson within the society in which he lived and to compare him with other entrepreneurs, first with those who were closest to him: his father, his brothers, and his nephews. More than others, he had the flexibility required to adapt himself to the transformations that the Canadian economy and western capitalism were undergoing. The evolution of industrial technology, the rise in incomes, and the increase in savings encouraged entrepreneurs to look more and more towards financial operations, in order that the savings of individuals could be built up to proportions appropriate to the growth in the capital equipment of business enterprises. William Molson’s career illustrates clearly that the first and indispensable condition for being an entrepreneur is to know how to take part in building up investment capital, either by acting on one’s own, or through one’s family, or – still better and more effectively – through the large financial institutions.

Materials on William Molson are distributed in several; archives. Among the most important sources are: the minutes of the board of directors’ meetings and of the shareholders’ meetings in the Archives of Molsons Bank (kept at the head office of the Bank of Montreal, Montreal) and in the Archives of the Bank of Montreal; the minutes of the board of directors’ meetings in the Montreal Board of Trade Archives; the minutes of the municipal council at AVM; the registers of notaries Thomas Barron, Isaac Jones Gibb, Henry Griffin, John Carr Griffin, James Stewart Hunter, William Ross, and James Smith at AJM; the Molson documents at Château de Ramezay (Montreal) and at the McCord Museum (McGill University, Montreal); and the William Molson collection at the Redpath Library (McGill University).

Without doubt the most important repository is the Molson Archives at the Molson’s Brewery, Montreal. This archives is described in an inventory prepared in 1955 for the Molson’s Brewery (copy in PAC, MG 24, D1). The following volumes were consulted: 321–24, 327–29, 349–52, 356, 360–67, 370–74, 383–85, 388, 390–91. The Shortt papers at the PAC (MG 30, D45) also contain interesting information on Molson. See also: Report of progress from 1866 to 1869 (Geological Survey of Canada, Montreal, New York, London, Leipzig, and Paris, 1870), 211–304. Merrill Denison, The barley and the stream; the Molson story . . . (Toronto, 1955); Canada’s first bank. Alfred Dubuc, “Thomas Molson, entrepreneur canadien: 1791 1863,” thèse de doctorat, Université de Paris, 1969 (in process of publication). Father’s Rest (Montreal, n.d.). G. C. Mackenzie, The magnetic iron sands of Natashkwan, county of Saguenay, Province of Quebec (Ottawa, 1912). Georges Ripert, Aspects juridiques du capitalisme moderne (Paris, 1946). B. K. Sandwell, The Molson family, etc. (Montreal, 1933). B. E. Walker, A history of banking in Canada; reprinted from “A history of banking in all nations,” . . . (Toronto, 1909). F. W. Wegenast, The law of Canadian companies (Toronto, 1931). G. H. Wilson, “The application of steam to St. Lawrence valley navigation, 1809–1840,” unpublished ma thesis, McGill University, 1961. René Bélanger, “Les forges de Moisie,” Saguenayensia (Chicoutimi, Qué.), VI (1964), 76–79; “Moisie; peuplement – mouvement de la population de 1860 à 1895,” Saguenayensia, VI (1964), 103–5. Alfred Dubuc, “Montréal et les débuts de la navigation à vapeur sur le Saint-Laurent,” Revue d’histoire économique et sociale (Paris), XLV (1967), 105–18. Jacques Monet, “La crise Metcalfe and the Montreal election, 1843–1844,” CHR, XLIV (1963), 1–19.

Cite This Article

Alfred Dubuc, “MOLSON, WILLIAM,” in Dictionary of Canadian Biography, vol. 10, University of Toronto/Université Laval, 2003–, accessed February 20, 2026, https://www.biographi.ca/en/bio/molson_william_10E.html.

The citation above shows the format for footnotes and endnotes according to the Chicago manual of style (16th edition). Information to be used in other citation formats:

| Permalink: | https://www.biographi.ca/en/bio/molson_william_10E.html |

| Author of Article: | Alfred Dubuc |

| Title of Article: | MOLSON, WILLIAM |

| Publication Name: | Dictionary of Canadian Biography, vol. 10 |

| Publisher: | University of Toronto/Université Laval |

| Year of publication: | 1972 |

| Year of revision: | 1972 |

| Access Date: | February 20, 2026 |