Source: Link

GAULT, ANDREW FREDERICK, merchant, industrialist, and philanthropist; b. 14 April 1833 in Strabane (Northern Ireland), youngest son of Leslie Gault, a merchant and shipowner, and Mary Hamilton; m. 12 July 1864 Louisa Sarah Harman, and they had a daughter and a son who survived infancy; d. 7 July 1903 in Georgeville, Que., and was buried in Outremont.

Andrew Frederick Gault, the “Cotton King of Canada,” was born into a large, prosperous, Anglo-Irish family in County Tyrone. He was the eighth of nine children (five boys and four girls) to survive infancy. His mother was a member of one of the old families of Donegal (Republic of Ireland). His father had built up a thriving business in general trade based in Strabane. By the 1820s he controlled much of the market in Tyrone as well as in one or two other counties. Soon afterwards, he branched out into shipping, sending his vessels, filled with emigrants, to New Brunswick and the United States, bringing them back loaded with timber and grain.

In the early 1840s Leslie Gault’s successes soured. A string of misfortunes crippled his business: three of his ships were lost at sea and investments in grain and timber resulted in heavy losses on falling markets. In a bold move he took his wife, the seven youngest children, and part of his remaining capital to Lower Canada in 1842 to make a fresh start in Montreal, the mercantile centre of British North America. Within nine months of their arrival he died of cholera. His wife fell sick and returned to Ireland to recover. The leadership of the family was taken up by Mathew Hamilton*, then 20, the eldest son in Montreal. His position became permanent after the death of Henry Stuart, the eldest of the children, in 1844 and that of John James, the second eldest, the following year.

Misfortune continued to plague the Gaults for the remainder of the 1840s. Living off the sale of properties in Ireland, they were none the less deeply affected by the failure of a bank. Farming proved to be a costly investment, absorbing $7,000. The turning-point for the Gaults did not come until 1851 when Mathew became an agent for two insurance companies; he acquired a third agency the following year. Nothing is known about how these events affected young Andrew. He was nine or ten years old when Mathew took over as head of the family. He attended the High School of Montreal, but may have been forced to withdraw before completing his schooling. For a time he was apparently involved in the family’s unsuccessful experiment with farming.

Not surprisingly, he turned to a career in trade, entering the dry-goods firm of Walter McFarlane (MacFarlane) to learn the business. In 1853 he began trading in partnership with James B. Stevenson under the name Gault, Stevenson and Company. Late in 1857 or early in 1858 the partnership was dissolved. A new company was formed by Andrew and his brother Robert Leslie. Later Gault Brothers and Company was expanded to include a brother-in-law, Samuel Finley.

Gault’s efforts were being watched by R. G. Dun and Company. In January 1858 he was described by its agents as “a single man, about 30 years of age [he was 24] . . . highly respectable . . . of excellent cha[racter] & hab[it]s, an hon[est], intelligent, industrious good bus[iness] an, has a cap[ital] of 25,000$, is very cautious and prudent.” Robert Leslie was also praised as “cautious, careful honest & trustworthy,” but his capital was reported at only $3,000 or $4,000. There is little doubt that Andrew was the leading partner.

The business was slow to grow. In 1860 the capital worth of the firm shrank to $24,000 and it had sales in the range of $75,000 to $100,000. In 1861 it was reported that the Gaults “have been pretty ‘hard up’ for money thro the fall & have been a gd deal talked abt.” The Gaults sought financing outside the banks (their mother, for example, advanced them $8,000), but R. G. Dun’s agents felt that the only solution was to “do less bus[iness] & with Economy.” The firm continued to struggle through 1862 and 1863. In June 1863 its net wealth was placed conservatively at $31,000, while sales were still in the range of $75,000 to $100,000.

Within a decade Gault Brothers and Company had been transformed. In 1873 sales reached $2,000,000, a twentyfold increase on its business ten years earlier. The firm’s net worth had leaped to somewhere between $150,000 and $400,000. Apparently the Gaults had not been content to “do less bus[iness] & with Economy.” Much of the growth had taken place over the previous two years. Their strategy had been to carry abundant stock, “distribute a very large amount of goods,” and “to take large risks” on business throughout Canada, thus widening their market. The firm continued to grow, branches opening in Manchester, England, Winnipeg, and Victoria. In 1896 it incorporated as Gault Brothers’ Company Limited with a capital of about $1 million. In 1922 it would move its headquarters to Winnipeg, by then its most prosperous branch.

Always shrewd, the Gaults had aggressively pursued the opportunity to earn substantial returns that would more than repay a host of small losses. This new strategy created the wealth that opened up seats for Andrew on the boards of directors of insurance companies, banks, and cotton textile firms. His brother Mathew, first managing director of the Sun Mutual Life Insurance Company of Montreal and president of the Exchange Bank of Canada, must have smoothed the way for Andrew’s entry into the directorships of insurance companies and banks. But Andrew soon made his own way. At various times, beginning in 1873, he would hold directorships in Sun Mutual, the Liverpool and London and Globe Insurance Company, the Royal Victoria Life Insurance Company, the Manufacturers’ Life Insurance Company, the City and District Savings Bank, the Royal Trust Company, the Molsons Bank, and the Bank of Montreal.

As his wholesale business and other interests grew, Gault became a prominent member of the Montreal Board of Trade and sat for a time on its board of arbitration. But he refused to enter politics – three times rejecting a senatorship, declining invitations to run for parliament, and turning down a request to run for the office of mayor of Montreal. His interests were well represented by his brother Mathew, who was twice elected mp.

It was through his investments in the manufacture of cotton textiles, an expanding domestic industry, that Gault managed to secure the continued growth of both his wealth and his reputation. The cotton textile industry began to attract the attention of Andrew and Mathew in the early 1870s. In 1872 Andrew invested more than $100,000 to build a cotton mill at Cornwall, Ont., the Stormont Manufacturing Works. The mill was destroyed by fire in 1874. The insurance paid $38,000, but the replacement cost of the plant and machinery was estimated at $250,000. Although the town of Cornwall offered “inducements” to rebuild, such as tax concessions, promises to buy stock in the company, or both, the Gaults turned their attention elsewhere. By 1879, however, they would be promoting the construction of a new mill in Cornwall, to be known as the Stormont Cotton Manufacturing Company Limited.

The Gaults in fact looked somewhat closer to home. Victor Hudon* had brought together a group of Montreal businessmen to invest in the V. Hudon Cotton Mills Company, Hochelaga, which began production in 1874. Three years later production started at the Montreal Cotton Company, a $400,000 mill that James Kewley Ward had acquired financial backing to build at Salaberry-de-Valleyfield. Andrew and his brothers Robert and Mathew acquired stock in both enterprises and served as directors. By the end of the decade Andrew was president of both enterprises, the largest in the industry.

In 1879, when the government of Sir John A. Macdonald* introduced its National Policy, the tariff on bleached and unbleached cotton cloth jumped from 17.5 per cent ad valorem to an average of 27 per cent; by order in council the 10 per cent duty on imports of cotton textile machinery was waived from 15 March 1879 to 1 Oct. 1881. The Gaults were ideally situated to take advantage of the heightened protection granted the industry.

Between 1879 and 1883 investment in cotton textiles soared. According to one set of estimates, the industry grew from 7 mills running 128,000 spindles and producing an output valued at $3,745,000 to 21 mills running 461,350 spindles with an output worth $10,400,000. In 1882 the Toronto Globe, no admirer of the National Policy, published a series of articles by Thomas Phillips Thompson* on the industry’s growth and profitability under the new tariff. Thompson argued that the Gaults and Montreal businessman David Morrice were prime examples of investors who had earned “handsome profits” even “under a low tariff’ in the 1870s and now had become “Cotton Lords,” availing themselves of “the full opportunity afforded by the new tariff to rob the general public of the Dominion.” While many had made large profits, Andrew and Mathew Gault were “the most fortunate among the fortunate.” On his stocks in the Hudon company Andrew was estimated to have earned 41.5 per cent in 1878 (before the National Policy) and 61.3 per cent in 1879, 77 per cent in 1880, and 82 per cent in 1881.

By 1883, however, the “bonanza” was over. The business press, watching as the industry slid into depression, described the boom of 1879–83 as an irrational “cotton orgy.” The result was “over production,” particularly in grey (unfinished) cottons. For the remainder of the decade the industry’s leading investors, directors, and managers would struggle with the problem of how to earn a “living profit” on their investments, which the National Policy had perhaps treated too favourably. From his position as president of mills at Hochelaga, Salaberry-de-Valleyfield, and Cornwall, Andrew Gault would play a leading role in the struggle.

“It is a truism among cotton manufacturers,” said the Journal of Commerce in 1883, “that while almost anybody can make Grey Cottons, it requires no little ability to make money at them.” To ensure the profitability of his companies Gault tried three solutions. The first was to diversify product lines. His mills at Cornwall and Hochelaga, for example, shifted away from greys to bleached and coloured cottons. He also attempted to find new markets for grey cottons, promoting the sale of, some might say dumping, exports in China and Japan. The third solution was to obtain agreements among the mills to control production, by cartel and by merger.

As a result of his efforts to organize production within the industry, Gault acquired the title of Canada’s “Cotton King.” At first he devoted his attention to hammering out during annual “Cotton Congresses” cartel agreements such as the Canadian Cotton Manufacturers’ Association of 1883 and the Dominion Cotton Manufacturers’ Association of 1886, serving as president of the dominion cartel. The difficulty in running cartels is well known: restrictions on output benefit the industry as a whole, but each company has a strong incentive to cheat by cutting prices below agreed-on minimum rates, and thereby grab a greatly enlarged share of the market. This incentive explains why New Brunswick industrialist Alexander Gibson* refused to participate in the cartels, preferring a free ride on their efforts, and why reports surfaced in the business press claiming that “special” discounts and generous credit terms were being used by some companies to disguise evasions of cartel policy. Although cartel agreements may have worked for a while (perhaps in 1886) to reduce production and raise prices, by 1889 Gault was convinced that the only effective solution lay in mergers.

Gault and Morrice masterminded two major mergers. In 1890 the Dominion Cotton Mills Company Limited was formed, combining seven firms producing mainly grey cotton goods. Two others were added the following year. In 1892 the Canadian Colored Cotton Mills Company Limited came into being; it merged seven enterprises which produced largely coloured goods. In addition, Canadian Colored Cotton Mills acquired the right, through marketing agreements, to control the output of two nominally independent companies, including Gibson’s. The mergers transformed the structure of the industry. In 1888, before they took place, its four-firm concentration ratio – the share of capacity measured by the installed spindleage of the four largest firms – stood at 52.2 per cent, and an alternative measure of the potential for collusive price-fixing, the Herfindahl index, stood at 0.11. In 1892 the ratio leaped to 97.6 per cent and the index to 0.30.

As a result, according to historian Michael Bliss, “through most of the 1890s the two cooperating firms [Dominion and Canadian] were able to control prices and production in the industry.” Gault, now in his sixties, had reached the height of his career in business. He was president of Canada’s three largest cotton textile firms, the Dominion, Canadian, and Montreal, and the companies’ mills were, according to the Canadian Magazine, “sprinkled with almost prodigal profusion across the country from Brantford, in mid-Ontario, to Halifax, down by the sea.” Another major merger would take place in 1905, after his death, establishing the Dominion Textile Company to deal with new competition.

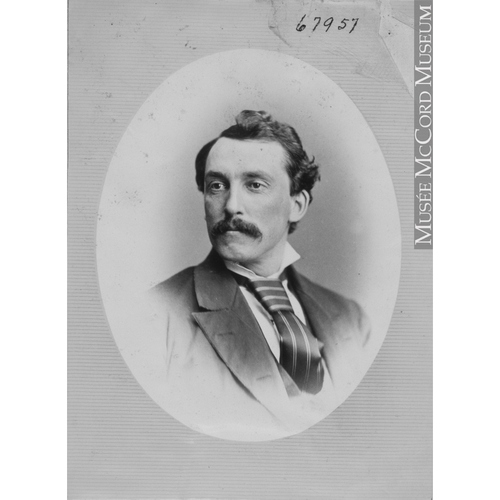

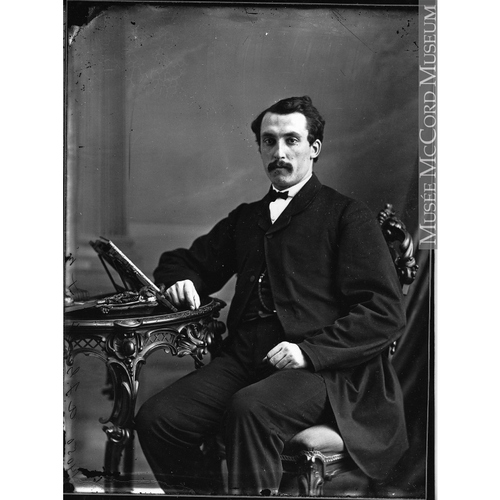

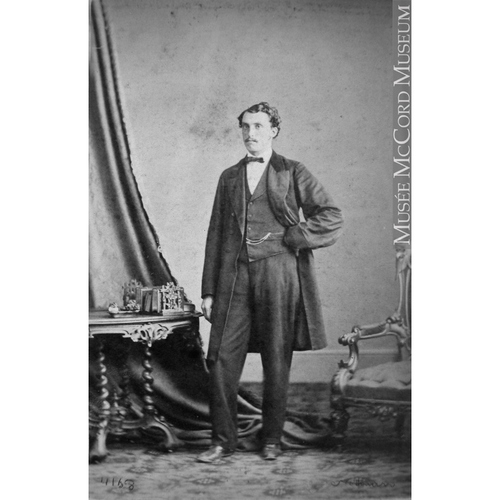

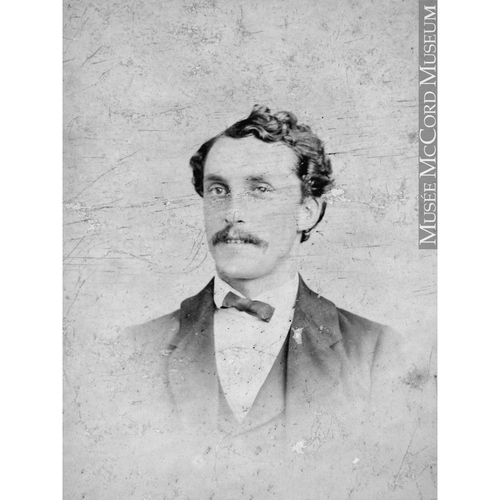

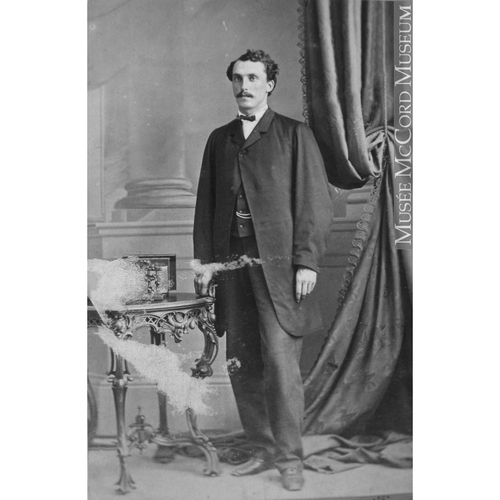

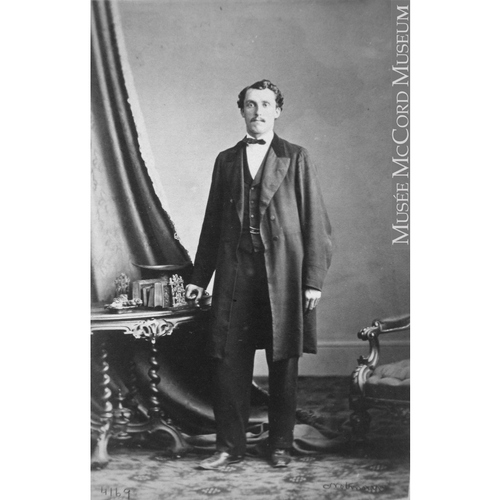

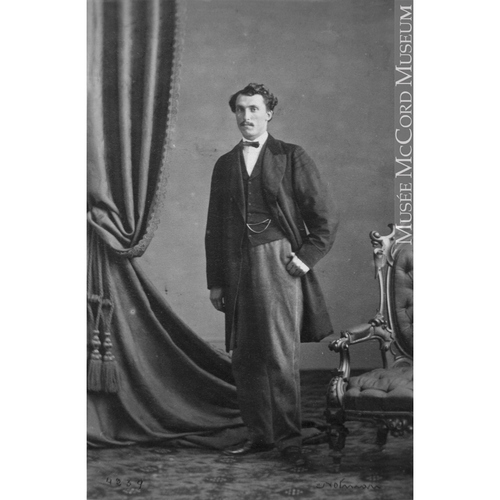

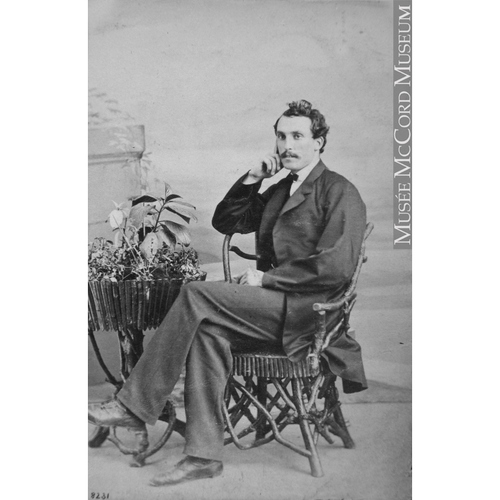

The man whom R. G. Dun’s agents had described as a “highly respectable young man” had become, in the words of the Canadian Magazine, a “millionaire twice over” and “a remarkable industrial exotic – a Cotton King in Canada.” Not surprisingly, his contemporaries linked his success to such characteristics as “energy,” “natural force of character,” “conspicuous ability,” and “clear-sighted business instinct.” Moreover, it was said that he was “as good a fighter as he was a friend.” His portraits make it easy to believe that Gault willed himself to success; tall, handsome, and self-assured, with a flowing moustache and square jaw, he could be mistaken for a prizefighter. Indeed, according to family legend, the reason his pictures show him at a three-quarter angle, the left side of his face presented to the camera, is because his right ear had been scarred in a struggle with a burglar whom he had surprised breaking into his mansion in Montreal.

It was in the cotton textile industry that Gault made his reputation as “a great organizer,” the creative administrator of companies and groups of companies. He did not establish the industry, but he transformed it. The technical problems of production did not concern him. Appearing before the royal commission on the relations of labour and capital in 1888, he replied to a query concerning his involvement in the management of the Hochelaga mill, “In the interior working of the mill I have taken I may say no interest whatever – that is no active interest.” The conditions inside the mills sometimes shocked the commission. Gault approached such matters, as one contemporary writer noted, “with a calm and philosophic spirit.” Asked whether he had told a Montreal newspaper that the children employed in his mills “were working too long hours,” he replied: “I said it was a pity that they were obliged to work so long.”

In addition to Gault Brothers and Company, the cotton industry, and his directorships in insurance and banking, Gault was involved in a large number of enterprises. These included the Dominion Commercial Travellers’ Association (1875), Farnham Beet Root Sugar Company (1879), Corriveau Silk Manufacturing Company (1883), Citizens Gas Company of Montreal (1883), Globe Woollen Mills Company Limited (1887), Canadian Woolen Mills Limited (1887), Campbellford Woolen Mills Company (1887), Crescent Manufacturing Company (1896), Havana Electric Tramway Company (1898), Boas Manufacturing Company (1898), and Trinidad Electric Light and Tramway Company (1901).

Apart from his business activities, Gault devoted his energies and his wealth to his family, the Church of England, and the community. In 1864 he had married Louisa Sarah Harman, daughter of Henry B. Harman of Surrey, England. They had two children who survived infancy: Lillian Mary Louisa, born in 1877, and Andrew Hamilton*, born in 1882. Plagued by stillbirths (four boys, one girl) and the deaths of two sons during infancy, they no doubt wished for a larger family. According to family lore, Gault’s desire for an heir – a healthy son – had led him to promise his bishop, William Bennett Bond of the diocese of Montreal, that if God would grant this wish he would provide a building for Montreal Diocesan Theological College, which he did. The story is a good one, but may be apocryphal – the building was purchased in 1881, the son born in 1882. The son did not share his father’s love for business. As quickly as possible, Andrew Hamilton Gault made a career as a soldier, rising to the rank of brigadier; he also became a politician, serving as an mp in England. He is perhaps best known for using his father’s wealth to raise what became one of the most celebrated regiments in World War I, the Princess Patricia’s Canadian Light Infantry.

For his family Gault built Rokeby, a mansion on Sherbrooke and Mountain streets, around 1875. Designed by Montreal architect John James Browne*, it was built in the “Scottish baronial” style, combining “Medieval battlements, towers and Gothic motifs.” The building was torn down in the 1920s. In the Eastern Townships, at Georgeville, he also maintained a summer residence, Glenbrook.

Gault’s success in business allowed him to play a prominent role as a philanthropist to his church and his community, giving of his money and, what came to the same thing, his time and effort. His church work and benevolent activities included founding the Gault Institute in Salaberry-de-Valley field; serving as treasurer of the synod of the diocese of Montreal and as a delegate to the General Synod of the Church of England in Canada; and acting as treasurer of the Robert Jones Memorial Convalescent Hospital, president of the Montreal Protestant House of Industry and Refuge, vice-president of Andrews Home, a member of the United Board of Outdoor Relief, a governor of McGill College, and a pillar of his church, St George’s, where he was a warden and superintendent of the Sunday school.

It is difficult to say precisely how much money he gave to good causes. On his death the lion’s share of his wealth went to his wife, son, and daughter, bound up in trusts; the son and daughter each received $1,307,888.35 when the estate was finally settled in December 1915. He left $54,000 in charitable donations in his will: $10,000 each to McGill College, the synod of the diocese of Montreal, and the Montreal Protestant House of Industry and Refuge; $12,000 to the Montreal Diocesan Theological College; $5,000 to the Montreal General Hospital; $2,000 to the Protestant Hospital for the Insane, at Verdun; and $1,000 each to the Sabrevois mission [see Bond], the Sheltering Home, the Young Men’s Christian Association, the Young Women’s Christian Association, and a Mrs Frost, for her evangelical work.

During his lifetime Gault had given far more than he bequeathed. In total, he donated between $150,000 and $200,000 for Montreal Diocesan Theological College, including a new building opened in 1896. Six years later he gave $5,000 towards the building of the bell-tower of St George’s Church. In 1899 he presented the church with its bells, tower-clock, and chimes. Many of his gifts, however, were given anonymously. Bishop James Carmichael paid tribute to his memory by describing him as “one of the best loved men that ever lived in this city.” “Never once,” he said, “have I asked him for help for the poor and sick and needy in vain. Again and again, unasked, he has given me that assistance, and that not only in late years, when his means were great, but in the early hours of friendship, when his future lay before him. . . . So I knew him, so hundreds have known him, the kindly, generous, wholehearted man, who often, literally, did good by stealth.”

Gault died in July 1903 of Bright’s disease, an inflammation of the kidney. His funeral, “one of the largest . . . seen in Montreal in years,” according to the Montreal Daily Star, took place on 10 July and he was buried in Mount Royal Cemetery. It was perhaps appropriate that the throng of mourners was swollen by the presence of “all the employees of Gault Brothers and of the Dominion Cotton Mills.”

[Family details, including an extract from a typescript family history, were kindly supplied by Leslie Gault of Montreal, and a photocopy of Gault’s will of 11 June 1902 was provided by Lieutenant-Colonel E. J. Williams of Somerset, England, who is preparing a biography of the subject’s son, Andrew Hamilton Gault. m.h.]. Baker Library, R. G. Dun & Co. credit ledger, Canada, 5: 42, 293; 6: 121; 7: 110. Mount Royal Cemetery Company (Outremont, Que.), Burial reg.; Gault family memorial marker. E. A. Collard, “All our yesterdays: Montreal merchant was generous giver,” Gazette (Montreal), 11 Oct. 1986: B-2. Gazette, 9 July 1903, 15 Dec. 1915. Globe, 13, 19–20, 23, 27, 30–31 May, 5, 10 June 1882. Monetary Times, 18 Sept. 1874; 18 Feb., 10 March 1876; 7, 14 Sept. 1883; 19 Aug. 1887. Montreal Daily Star, 8, 10, 13 July 1903; 15 Dec. 1905. “Montreal then and now: textile magnate built himself medieval castle,” Gazette, 19 Nov. 1988: K-16. B. J. Austin, “Life cycles and strategy of a Canadian company, Dominion Textile: 1873–1983” (phd thesis, Concordia Univ., Montreal, 1985). Michael Bliss, Northern enterprise: five centuries of Canadian business (Toronto, 1987). Can., Parl., Sessional papers, 1878–83, tables of trade and navigation; Royal commission on labour and capital, Report; Royal commission on the textile industry, Report (Ottawa, 1938). Canada, an encyclopædia (Hopkins), 5: 535. Canadian men and women of the time (Morgan; 1898). Canadian textile directory . . . (Montreal), 1888/89, 1892. A. R. C[arman], “Canadian celebrities, xliv – Andrew F. Gault,” Canadian Magazine, 21 (May–October 1903): 201–3. W. A. G. Clark, Cotton goods in Canada, U.S., Bureau of Foreign and Domestic Commerce, Special agents ser., no.69 (Washington, 1913). Dominion Dry Goods Report (Montreal), 1 (1883–84): 2, continued as Canadian Journal of Fabrics (Toronto and Montreal), 9 (1891–92): 4 (copies at HPL). An encyclopaedia of Canadian biography, containing brief sketches and steel engravings of Canada’s prominent men (3v., Montreal and Toronto, 1904–7). A. P. Gower-Rees, Historical sketch of St. George’s Church, Montreal, and its constitution (Granby, Que., 1952). G. H. Harris, The president’s book; the story of the Sun Life Assurance Company of Canada (Montreal, 1928). Journal of Commerce, Finance and Insurance Rev. (Montreal), 16 (23 Feb.–17 Aug. 1883): 1136, 1644–45; 23 (July–December 1886): 456–57; 26 (January–June 1888): 68; 31 (July–December 1890): 833–34. Montreal, Board of Trade, Statements relating to the home and foreign trade of the Dominion of Canada; also, annual report of the commerce of Montreal . . . (Montreal), 1878/79, 1880–82. Naylor, Hist. of Canadian business.

Cite This Article

Michael Hinton, “GAULT, ANDREW FREDERICK,” in Dictionary of Canadian Biography, vol. 13, University of Toronto/Université Laval, 2003–, accessed February 17, 2026, https://www.biographi.ca/en/bio/gault_andrew_frederick_13E.html.

The citation above shows the format for footnotes and endnotes according to the Chicago manual of style (16th edition). Information to be used in other citation formats:

| Permalink: | https://www.biographi.ca/en/bio/gault_andrew_frederick_13E.html |

| Author of Article: | Michael Hinton |

| Title of Article: | GAULT, ANDREW FREDERICK |

| Publication Name: | Dictionary of Canadian Biography, vol. 13 |

| Publisher: | University of Toronto/Université Laval |

| Year of publication: | 1994 |

| Year of revision: | 1994 |

| Access Date: | February 17, 2026 |